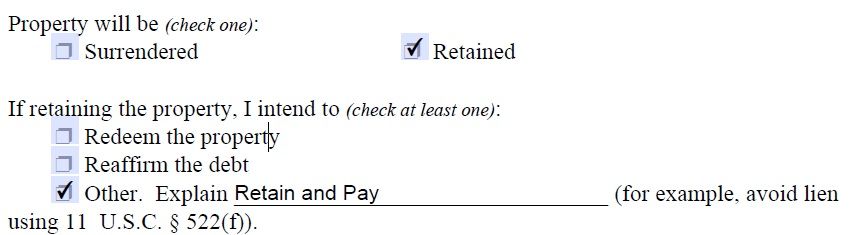

While signing my papers yesterday, the conversation returned to the 3 options for secured property, i.e. my home. (Lawyer insists that 'other' is for personal property only.) I was told my only options were, reaffirm and surrender. I asked if I were to reaffirm at this time, and then change my mind could I select either surrender or 'other' at that time then? No, surrender was the only option left.

My question, is this true? Why don't I get to have both choices? If you can help out on this, I'd sure appreciate it! Thanks!

My question, is this true? Why don't I get to have both choices? If you can help out on this, I'd sure appreciate it! Thanks!

Comment