I have 60,000 in cc and personal loans with a minimum payment of 1350 a month. I have a first Mortgage of 295,000 a second for 70,000, and a third for 58,000. My total mortgage payment is 3100 a month. My home is valued between350,000-370,000. My wife is a stay at home mom and cares for our three children. i make between 4500-6200 a month depending on overtime. I am current on everything but barely. We just recently took out 3000 in a 529 to stay afloat. I am in Md. Will I qualify for a 7? or a 13? My salary without overtime is 73,000. We are hoping to qualify for a 7. Advise? thanks.

top Ad Widget

Collapse

Announcement

Collapse

No announcement yet.

7 or 13??

Collapse

X

-

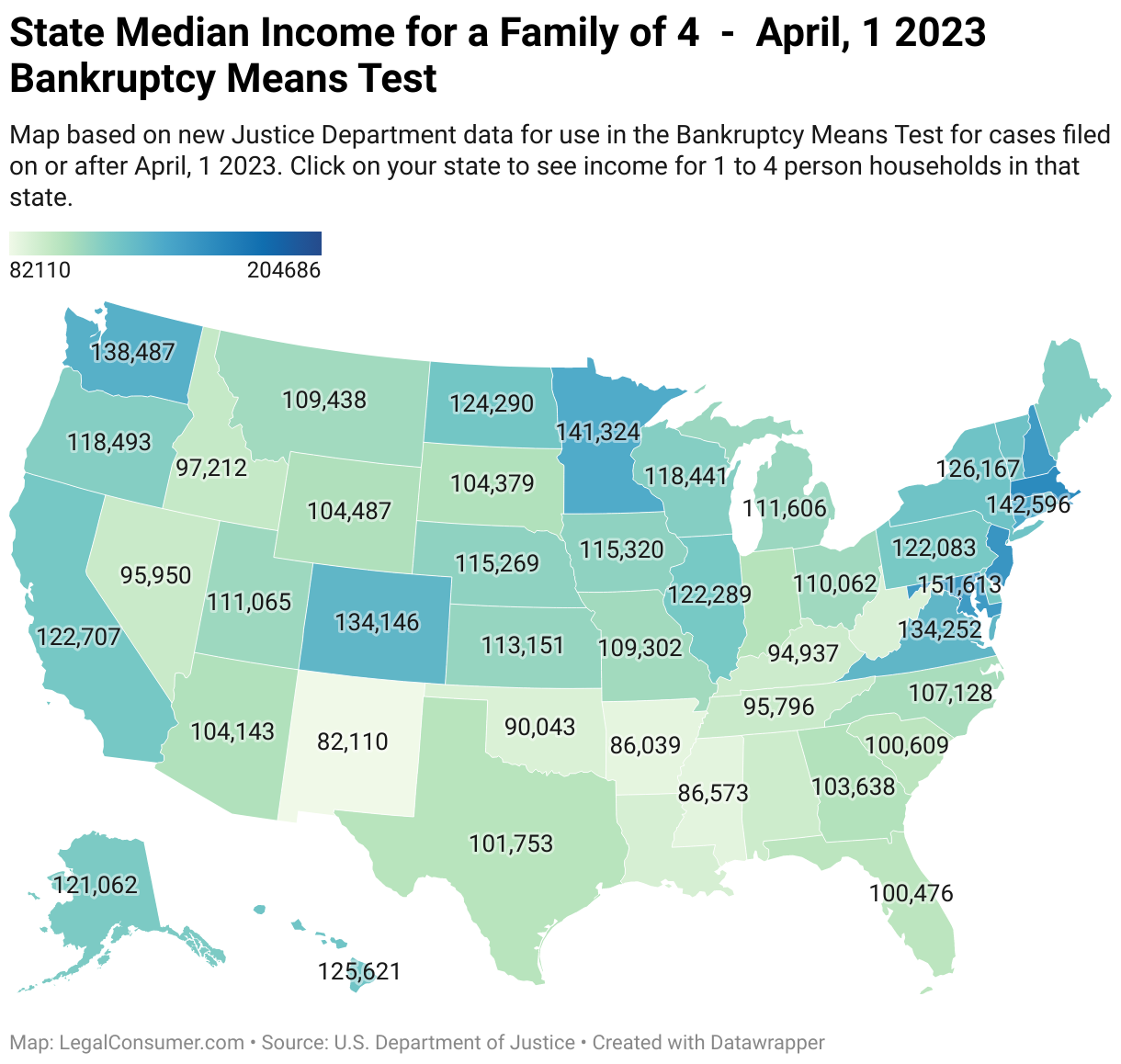

Odds are, you'll qualify for a Chapter 7.

Run these numbers and see where you stand.

Do you want to keep the house?

Most bk lawyers give free or lowcost initial consultations. Speak with a few and see what they say.

For heavens sake, stop using 529's for living expenses. A good chunk of those {depending on the timing of the contributions} are exempt from creditor seizure in bk. Don't raid 401K's or IRA's either.

If bk is a viable option, stop paying all debt you wish to discharge and use that money for living expenses. If you still can't support yourself, you'll need to really think about downsizing.

-

Agreed, you must barely be making it! Just wanted to add something, it's something I found out and was shocked by.... do not use ANY credit cards for a month, then see if you still have the amount of money left over every month you think you do. Once I started living on cash only, and stopped paying my CC's, I was just ignorant to the fact that I was living off the cards. I may have had 1k in payments going out to CC's, but would charge that 1k right back and then some, just to get by. It was an eye opener.

Comment

-

This is exactly what we were doing. I though once we stopped paying the cards, we would have tons of money. So not the case. We were using the cards for so much that we shouldn't have been.Originally posted by DEBTCHAINS View PostAgreed, you must barely be making it! Just wanted to add something, it's something I found out and was shocked by.... do not use ANY credit cards for a month, then see if you still have the amount of money left over every month you think you do. Once I started living on cash only, and stopped paying my CC's, I was just ignorant to the fact that I was living off the cards. I may have had 1k in payments going out to CC's, but would charge that 1k right back and then some, just to get by. It was an eye opener.Filed 8-21-09

341 10-9-09

12-14-09 Discharged

12-29-09 CLOSED!!!

Comment

bottom Ad Widget

Collapse

Comment